Background

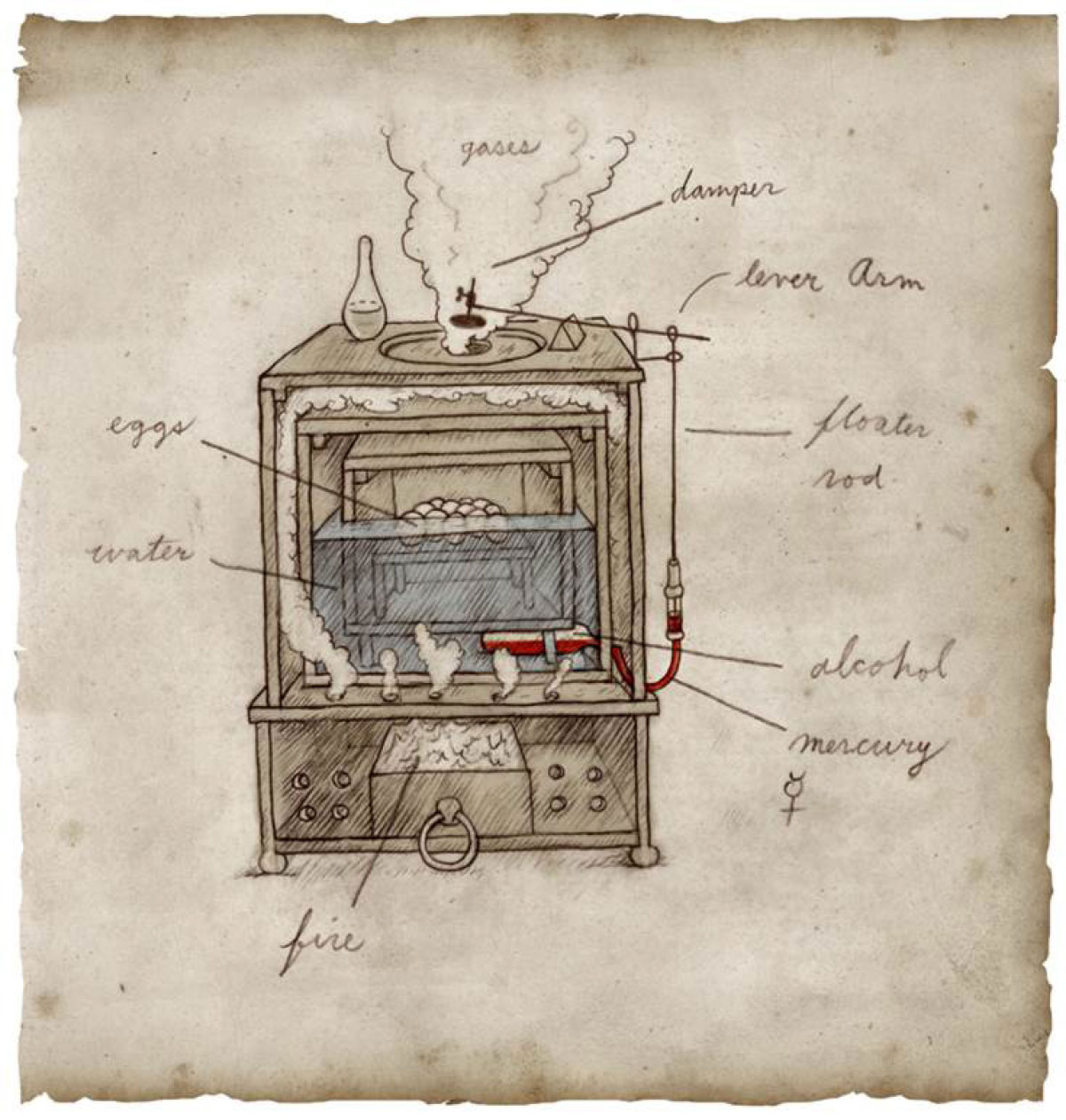

Over 400 years ago humans became curious about inventing ways to regulate and control temperature. By 1620, Dutch inventor Cornelius Drebbel started developing a simple mercury thermostat to regulate temperature and by 1906 Mark Honeywell would unveil the first programmable thermostat allowing customers to control heat levels and automatically pre-set temperatures. Fast forward a century and there are now 750 million thermostats in operation in the United States alone. While there have been small strides in the evolution of the device by major incumbents, a very small percentage of those devices were built to save energy and take advantage of the advances in low cost sensors, WiFi connectivity and automation.

Through valiant execution, a focus on customer usability and leveraging software to ‘learn’ user habits over time, Nest Labs was able to apply ubiquitous technology to transform an industry that was large yet forgotten by most investors. Just four years after starting the company, Nest catalyzed the ‘smart home’ movement by turning a simple temperature regulator into a gateway and platform. We call this process the Evolution of Industries.

How it happens

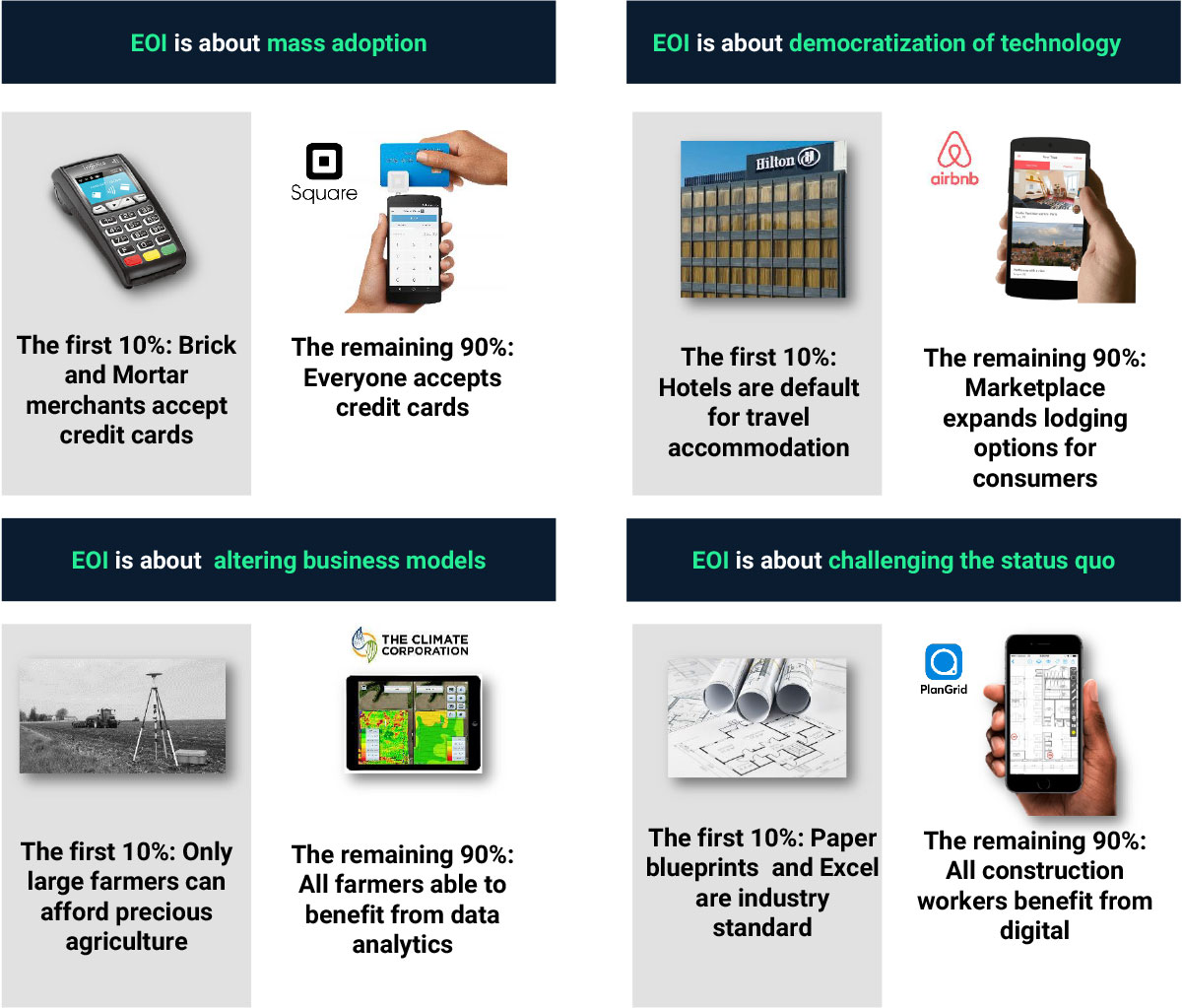

The Evolution of Industries happens when technical innovation is paired with operational excellence to transform a large, often antiquated, industry. Nest, Microsoft, SpaceX, Square and Amazon are all examples of companies and technology platforms that fit in the Evolution of Industries model. The goal of these companies was not technical innovation but rather mass adoption and disrupting the status quo. For Amazon, it was displacing brick and mortar retail with an online marketplace for goods. For Microsoft, a PC on every desktop. For SpaceX developing a reusable rocketship. For Square, making small merchant credit card payments mainstream. For Nest it was fundamentally re-designing the thermostat to serve as the central hub for anything related to the home.

The evolution of industries results in creative destruction of old business models and technology. Microsoft killed the typewriter as the primary form of word processing. Another telling example was the transformation in the photography industry with Kodak’s rise and fall. The company was founded in 1888 and at the height of its success the company employed 150,000 people and controlled 90% of film sales and 85% of camera sales in the US alone. Fast forward to 2012 when the company eventually filed for bankruptcy, it became clear the company had not evolved its legacy business model fast enough to compete with the evolution of digital photography and the proliferation of popular photo sharing apps like Instagram.

The cycles of innovation

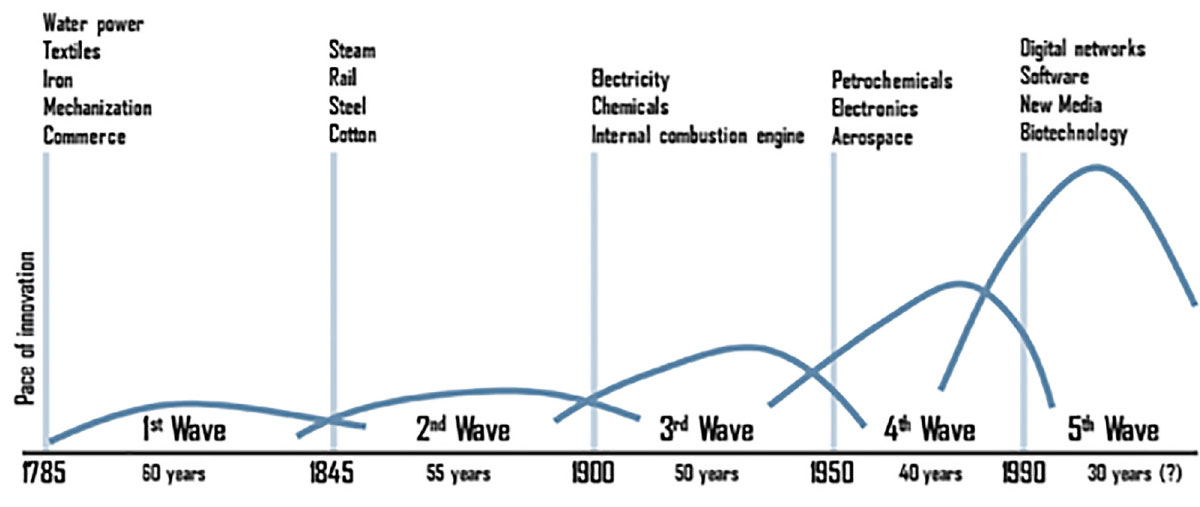

To recognize the importance of the Evolution of Industries as an investment thesis, one has to recognize that the innovation driven economy is not linear or exponential but rather cyclical, an idea first pioneered by the Soviet economist Nikolai Kondratiev in the 1920s and brought to mainstream thought through the work of Joseph Schumpeter, the father of Creative Destruction theory.

The cycles or waves arise from the bunching of basic innovations that launch technological revolutions that, in turn, create leading industrial or commercial sectors. But the time between these technical innovations can take decades: it took about 50 years between the steam engine and the railway cycle, and almost 40 years between the petrochemical revolution of the mid-1960’s till the IT revolution of the 2000’s. During the down cycles, value is most realized not through inventing new technologies but rather through the dissemination of the recently discovered technology into existing industries. Many of the greatest technology companies of our era were both incepted and grew during major down cycles. ARM, which now powers a majority of the world’s smartphones, was founded in the downturn of 1990. Cisco, which has become the dominant network and infrastructure vendor of our time, was founded and hired its first CEO shortly after Black Monday in 1987. Electronic Arts, a pioneer in electronic gaming, was founded in the middle of the Great Depression in May 1982. More recently Airbnb, Spotify and Stripe were all founded in the midst of the 2008 Global Financial Crisis.

How to win

Winning in the Evolution of Industries takes different forms. But an analysis of winning companies show a few key ingredients around founders, timing, and operational execution. As with all forms of innovation, the hero is the entrepreneur. But founders in the Evolution of Industries have particular traits that set them apart: they are valiant operators as opposed to ardent technologists. And they are obsessed with mass adoption over a particular product vision. It’s no surprise that Microsoft won over Apple in the PC battle of the 1980s because Bill Gates was obsessed with cost, which drove mass adoption, while Steve Jobs was obsessed with perfection. Similarly, Tony Fadell became obsessed with developing the most usable thermostat for energy savings, which led to mass adoption and ultimately a home automation ecosystem.

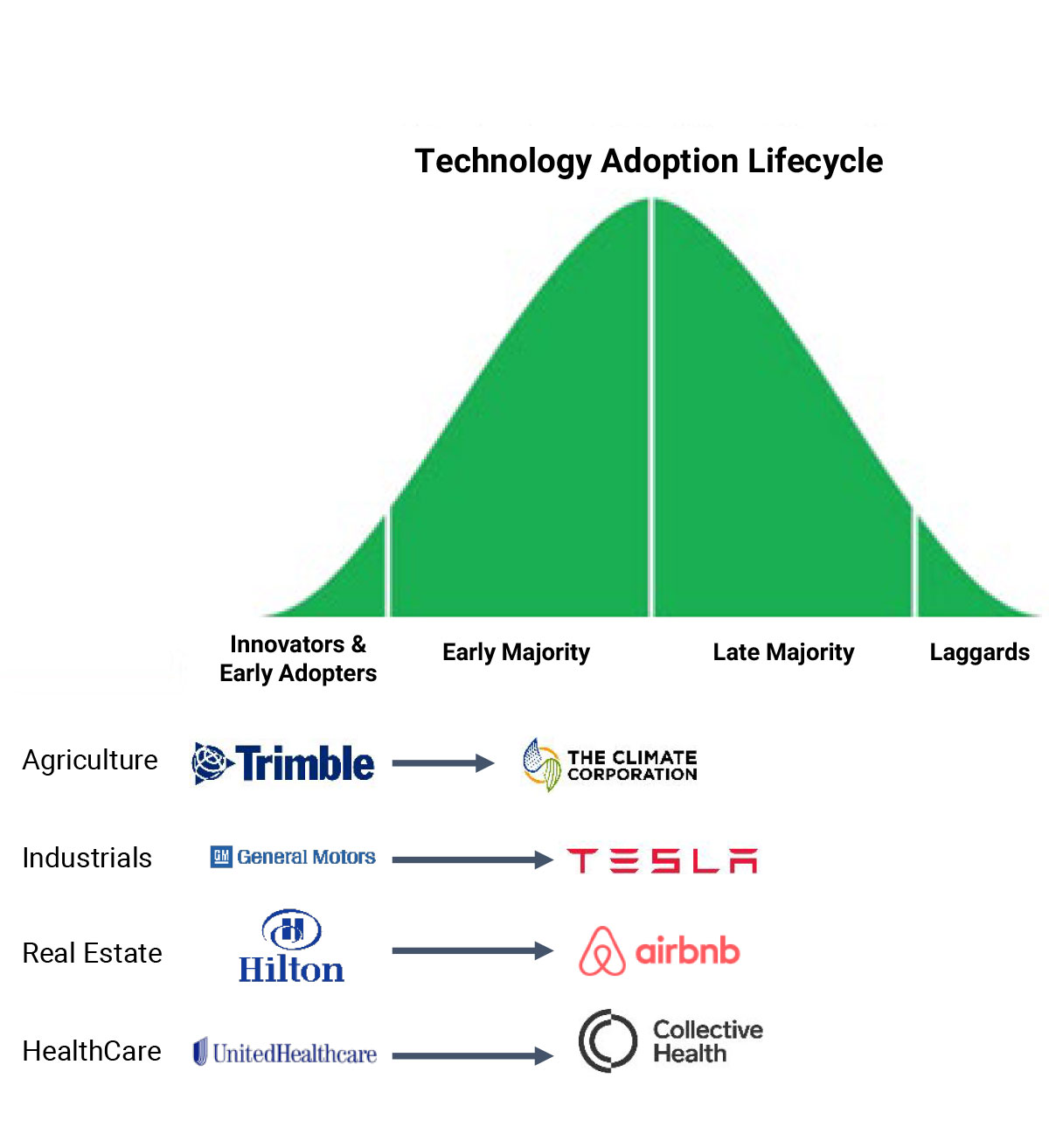

Being a “first mover” is also not a requirement for companies focusing on the Evolution of Industries, in fact it can be a hindrance. Founders need to time the market, waiting on the technology to not only be available, but also widespread and cost effective. New technologies are frequently utilized as a solution looking for a problem to solve, but the best founders focus on applying existing and well understood technology to markets that have been underserved by prior advancements. Climate Corporation, for example, wasn’t the first company to use historical weather data to inform growing behavior - since 1818 the Farmer’s Almanac has a storied place on the bookshelves of growers. However, Climate was able to apply data analytics to better leverage soil and field data in assisting farmers with improving crop yields while also providing downside risk mitigation.

Bringing disruptive technology to antiquated industries will also require entrepreneurs with strong operational backgrounds. Successful founders need to combine industry knowledge with a focus on execution and scaling the product. In the case of Square, accepting credit cards was not the challenge, instead it was scaling up their product and getting it into the hands of small merchants across the country. Their operational excellence allowed them to build valuable partnerships and distribute their product through high volume retail channels such as the Apple Store.